PORTA CUSD 202: Financial Path Forward

Maximizing Every Tax Dollar for Students

For the past decade, PORTA has relied on Working Cash Bonds to cover annual Education and Transportation Fund deficits. While this approach has helped maintain strong programs, it’s not a good sustainable long-term solution. The Board is exploring a debt extension and levy realignment plan to strengthen the Education Fund without raising the tax rate.

The Challenge

Every few years, the district issues Working Cash Bonds to fund operations and repays them with property taxes, which adds interest costs and continues borrowing. Without a change, the district will need to continue utilizing Working Cash Bonds or will face over $2 million in program cuts to balance the budget—impacting sports, arts, vocational programs, and essential staff.

The Proposed Solution: Extending Debt and Rebalancing the Levy

By refinancing debt and extending the repayment schedule, PORTA can lower annual bond payments. This creates levy capacity that can be shifted to the Education Fund while keeping the overall tax rate steady.

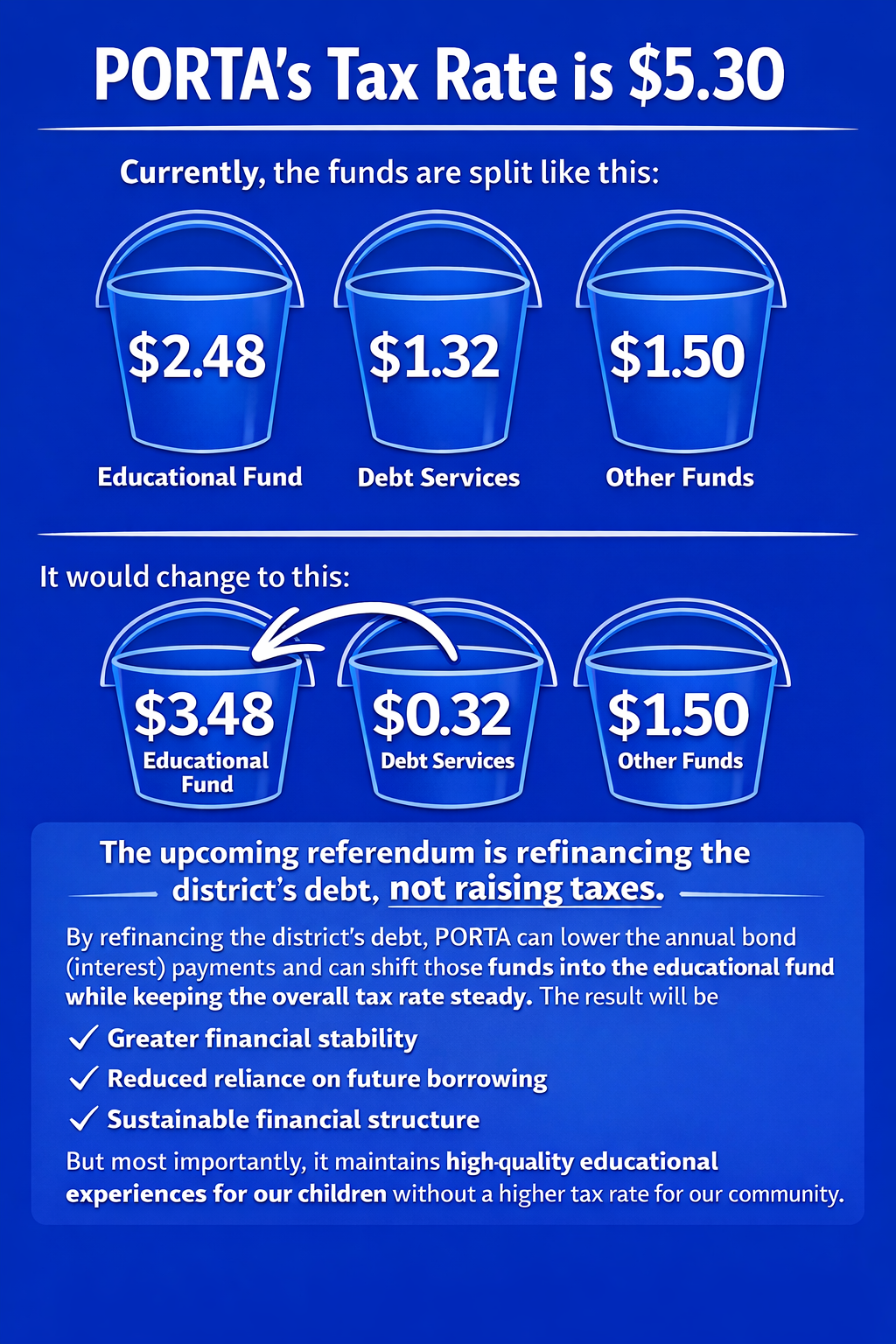

Total District Tax Rate = $5.30 per $100 assessed value • Education Fund: $2.48 • Debt Service: $1.32 • Other Funds: $1.50. Proposed Realignment: • Education Fund increases to $3.80 • Debt Service decreases to $0.00 ($0.32 will be abated from Education Fund to make new lower Debt Service payment)• Overall rate remains $5.30 (no tax rate increase). Each year, funds will be transferred from the Education Fund to the Debt Service Fund until the bonds are retired, ensuring 100% of local dollars stay in classrooms once the bonds are retired.

Benefits to the District and Community

■ No Tax Rate Increase – Keeps the overall levy rate steady.

■ Protects Student Programs – Avoids $2 million in cuts.

■ Financial Stability – Reduces reliance on future borrowing.

■ More Dollars in Classrooms – Frees funds for instruction and support.

■ Sustainable Future – Ensures long-term educational quality.

Without Action

Without working cash funds or extending the debt and adjusting the levy, PORTA would be forced to cut extracurricular and fine arts programs, vocational and technology education, nurses and aides, field trips, elementary and high school teaching positions, the pool, and even the School Resource Officer. These reductions would greatly impact students, staff, and community pride.

In Summary

This plan maintains educational quality and fiscal stability—protecting programs, staff, and students without raising the tax rate.

Strong Schools Build Strong Communities.

PORTA CUSD 202 Referendum Q&A

What is the purpose of this referendum?

The referendum asks voters to approve increasing the Education Fund’s maximum rate from 2.48 to 3.80. This change will not raise the overall tax rate but will strengthen the district’s Education Fund so that more dollars go directly into classrooms instead of toward interest payments on debt.

Will this referendum raise my taxes?

No, this referendum will not raise the district’s tax rate. The total tax rate will remain about $5.30 per $100 of assessed value, which is the same as it is now. However, your individual tax bill may still change if the assessed value of your home or property changes. If your property value increases, your taxes could rise accordingly — but not because of this referendum. This plan simply reallocates existing tax dollars — moving funds from the Debt Service Fund (used to pay bonds and interest) to the Education Fund (used for instruction, staff, and programs). In short, the tax rate stays the same, but the money is used more effectively to support classrooms.

Why is this change necessary?

For the past decade, PORTA has relied on Working Cash Bonds—essentially short-term loans—to cover operating expenses in the Education and Transportation Funds. While this allowed the district to maintain programs, it’s not a sustainable long-term solution. Each bond issue adds interest costs and keeps the district in a borrowing cycle. This referendum offers a permanent fix that creates stability without additional tax burden.

How does the plan work?

By refinancing and extending the current debt, PORTA can lower annual bond payments. This creates room to shift levy capacity from the Debt Service Fund to the Education Fund, allowing the district to cover expenses directly rather than borrowing. Once existing bonds are paid off, 100% of local tax dollars will stay in classrooms instead of paying interest on bonds (loans).

What happens if the referendum does not pass?

If the referendum fails, the district would need to cut nearly $2 million in programs and staffing to balance the budget. Possible reductions include: athletics, vocational and technology programs, music and arts, field trips, nursing and aide positions, teaching positions, the pool, and the School Resource Officer. These cuts would significantly impact students, staff, and community pride.

How will this plan benefit students and the community?

- No tax increase for local residents.

- Avoids deep cuts to student programs and staff.

- Reduces future borrowing and interest payments.

- More classroom funding for instruction and support.

- Long-term financial stability that protects educational quality.

Strong schools make strong communities—and this plan ensures both.

What exactly is the Education Fund used for?

The Education Fund supports the core of the school experience, including:

- Teacher and staff salaries

- Instructional materials and curriculum

- Student support services

- Athletics, fine arts, and extracurricular programs

- Health insurance and student programming

It is the largest and most essential fund in the district’s levy system.

What is Working Cash, and why has the district relied on it?

The Working Cash Fund is like a savings account that can be tapped to cover short-term expenses. When deficits occur, the district sells Working Cash Bonds, uses the proceeds to pay bills, and then repays those bonds through property taxes—with interest. Over the last decade, PORTA has had to use this method to maintain programs. The referendum aims to end this borrowing cycle permanently.

What does “keeping the tax rate steady” mean?

It means the total rate taxpayers pay to the school district will not change. While the Education Fund rate will increase from $2.48 to $3.80, the Debt Service rate will decrease, resulting in no change to the overall rate of $5.30 per $100 of assessed value.

What will the ballot question say? I’ve heard it will mention a tax increase.

The wording of the ballot question is set by state law, and it may sound like it authorizes a tax increase. However, the actual plan will not raise the total tax rate. By law, the ballot question must describe an increase in the amount of funds levied over the prior year, as a percent increase. It does not explain how the district will lower the Debt Service Fund rate at the same time to keep the overall tax rate steady. In other words, the ballot language can be misleading without context — it only refers to the Education Fund increase, not the offsetting decrease in Debt Service. The district cannot finalize the refinancing of existing debt or reallocation of Working Cash Funds until voters approve the ballot question. Once that happens, those steps will ensure that the total tax rate remains the same while creating long-term financial stability. Please click on this link for the actual ballot question and a much more detailed FAQ about the ballot question.

When will voters decide on this measure?

The referendum will appear on the March 17, 2026 election ballot. Voters will be asked to approve the increase in the Education Fund’s maximum tax rate from 2.48 to 3.80 to stabilize district finances and protect educational programs.

When was the last time the Education Tax Rate was adjusted?

The maximum tax rate for all funds was determined when the District last consolidated (1963)...... Petersburg, Oakford, Rock Creek, Tallula, and Atterberry consolidated to form the PORTA Community Unit School District 202.

I saw the Truth in Taxation Notice in The Observer. What does that notice mean and does it have anything to do with the referendum?

Illinois’ Truth in Taxation Law requires school districts to publish a notice and hold a public hearing any time the proposed tax levy exceeds 105% of the prior year’s extension. This requirement is triggered even when individual taxpayers may not see increases of that magnitude in their own bills. The purpose is to ensure full public awareness and the opportunity for community dialogue.

What the Numbers Mean and Why They Do Not Reflect a Tax Rate Increase

The figures in the Truth in Taxation notice represent the amount of money (the levy) that the District is requesting for 2025. They do not represent the tax rate that will appear on an individual homeowner’s tax bill.

This distinction is important because tax bills are determined by two factors:

● The District’s levy (what the District requests)

● The total Equalized Assessed Value (EAV) of all property in the District (the size of the tax base)

The County Clerk sets the actual tax rate by dividing the levy by the total EAV. The formula is:

● Tax Rate = Levy ÷ Total District EAV

This means:

● If the tax base grows, for example, because of new construction, rising home values, or reassessment

across the community, then the tax rate can go down, even if the District’s levy goes up.

● If the tax base stays the same or shrinks, the rate may increase even with a smaller levy.

Why the Notice Can Seem Misleading

Illinois law requires a Truth in Taxation notice whenever the levy increases by more than 5%, even if:

● The final tax rate stays the same, or

● The tax rate decreases, or

● The impact on individual homeowners is far lower than the levy increase percentage.

Because of this, the notice often appears to signal a tax rate hike when it does not.

A Simple Example

Imagine the District requests $12 million, and the total EAV of all taxable property is $300 million:

● Tax rate = $12,000,000 ÷ $300,000,000 = 4.0%

If the District requests slightly more the next year—say $12.3 million—but the tax base grows to $325 million through reassessment or new construction:

● Tax rate = $12,300,000 ÷ $325,000,000 = 3.78%

Even though the levy increased, the tax rate went down.

What This Means for PORTA #202 Taxpayers

The District’s proposed levy reflects operating needs and inflationary costs. However:

● The County Clerk will determine the tax rate in spring 2026.

● The change in EAV for the PORTA area is the largest factor in determining whether tax rates rise, fall,

or stay steady.

● Homeowners will not know their actual tax bill impact until rates are set by the county.

In short: The levy increase in this notice does not translate into a tax rate increase. In fact, the District’s proposed levy will likely keep the tax rate steady, or even slightly below the current 5.30 tax rate. The Truth in Taxation Notice has nothing to do with the referendum. The District has published the Truth in Taxation Notice numerous times throughout the years, especially if the EAV is expected to increase by more than 5%.

Where can I learn more or ask questions?

Visit www.porta202.org or contact:

Mr. Shannon Duling, Superintendent

sduling@porta202.org

Phone: (217) 632-3803

October Board Meeting Presentation Video:

Please click on the video below to review the information shared with the Board of Education on October 16, 2025.

BOARD MEETING NOTES (REFERENDUM INFORMATION):

Below is a summary of Board meeting discussions, presented in reverse chronological order, highlighting key conversations related to the referendum. It provides an overview of information drawn from our Public Board Notes, which summarize each monthly meeting.

December 18, 2025 Board Meeting: The Board formally approved a resolution providing for and requiring the submission of the proposition of increasing the existing tax rate for education purposes to the voters of the District at the general primary election to be held on March 17, 2026. This action will add the ballot question to the March 17th primary election.

November 13, 2025 Board Meeting Discussion (Ballot & Debt Restructuring): Mr. Duling shared a draft of the ballot question along with the projected debt payoff schedule. He explained that the ballot question, as written, does not reflect the District’s plan to extend its current debt. This strategy would allow the District to increase the Education Fund tax rate without raising the overall tax rate. The ballot question proposes a $1.32 increase to the current $2.48 Education Fund rate. A key message for the community is that, even with this increase, the District’s total tax rate is expected to remain under 5.30. To support this plan, the District will likely need to extend both current and new debt to a 13-year schedule. This adjustment would lower the District’s annual debt payment from $2.9 million to approximately $750,000, freeing about $2 million each year in the Education Fund to address ongoing deficit spending. .

October 16, 2025 Board Meeting Presentation: Referendum: Financial Path Forward – Working Cash to a Stable Education Levy: Mr. Duling shared a presentation that provided information on the District’s historical use of working cash bonds, how the District levy works, the plan for increasing the education fund rate without raising taxes, and the impact of not utilizing working cash or voter approval to raise the education fund rate (cuts that would need to be made to balance the budget). Please click on the link above for the presentation that was shared at the Board Meeting.

September 18, 2025 Board Meeting Discussion: Mr. Duling reviewed the proposed FY26 District budget. Projected deficits include ($1,553,734) in the Education Fund, ($355,200) in the Transportation Fund, and ($100,361) in the Municipal Retirement /Social Security Fund. The Education Fund will be covered through moving $1,500,000 from the Working Cash Fund and both the other fund deficits will be covered through existing fund balances. Mr. Duling made note that the auditors had the District make the just over $100K entry fee into Central Illinois Educators (health insurance coop) out of the Municipal Retirement/Social Security Fund leading to the large deficit in that Fund. At the end of the year, we are projecting ending fund balances of:

- Education Fund $501,770

- Operations & Maintenance $1,065,000

- Debt Service $302,695

- Transportation $382,556

- Municipal Retirement/Social Security $311,785

- Capital Projects $895,600

- Working Cash $638,317

- Tort $253,096

- Fire Prevention & Safety $486,614

Based on the current budget projections, the District will need to make significant spending cuts if the referendum in March does not pass. Mr. Duling is developing a list of potential reductions that would be required in order to balance the budget without relying on transfers from the Working Cash Fund. For many years, the District has used Working Cash to cover ongoing deficit spending. The referendum seeks to increase the District’s Education Fund tax rate so that day-to-day operating costs can be supported directly, rather than depending on issuing Working Cash on an ongoing basis. Utilizing the Education Fund tax rate will reduce, and eventually eliminate, the interest tax payers pay in utilizing Working Cash.

The District is also likely going to need to utilize the fund balance in Capital Projects, as well as some out of O&M, to address significant parking lot repair/replacement costs at both Central and the Junior Senior High School over the next few years.

August 21, 2025 Board Meeting Discussion: The Board conducted a review of the District’s current tax rate (5.30) in comparison to area school districts and examined projected bond retirement schedules prepared by King Financial. The discussion focused on the feasibility of increasing the Education Fund rate through a tax rate swap with the District’s long-term debt levy. Currently, all outstanding bonds are scheduled to be retired by the end of 2028. To maintain a consistent overall tax rate while reallocating levy capacity to the Education Fund, the District would likely need to extend its bonded debt amortization through approximately 2035. This approach would provide the flexibility to increase the Education Fund rate without raising the District’s total tax rate. The Board emphasized the importance of balancing this strategy against current economic pressures faced by families in the community and the overall tax burden in Illinois. With a clearer understanding of how a levy swap could be structured, the Board will begin evaluating the long-term financial implications for the District, including debt capacity, operating revenue stability, and sustainability of educational programming.

July 24, 2025 Board Meeting Presentation and Discussion: Following discussions at the Joint Board Meeting with AC-Central and their subsequent regular

meeting, the PORTA Board believes AC-Central is not prepared to move forward with the feasibility study in a timely manner. Comments from their members, citing up to four years to complete the study as allowed in the Co-op Agreement, indicate a slower pace than PORTA’s needs required.

Even if AC-Central agreed to begin the study immediately, the earliest any resulting consolidation question could appear on a ballot would be November 2026. For PORTA, waiting that long would require issuing additional working cash bonds to maintain current operations. If a consolidation measure failed in 2026, the District would still face the need for another bond issue the following year while pursuing an Education Fund Referendum.

Given this timeline and AC-Central’s hesitation, the PORTA Board believes it is in the District’s best interest to proceed with an Education Fund Referendum, with a likely target of the March 2026 election. As emphasized in Dr. Wright’s presentation, this process must include a clear vision for PORTA’s future—both with and without an Education Fund increase—so the community can make an informed decision based on the District’s needs and available resources.

June 26, 2025 Board Meeting Discussion: The Superintendent presented the amended budget, as well as reviewed a financial report depicting revenues and expenditures as compared to the previous three years. The amended budget (a true reflection of this year’s finances, is estimating a $2.1 million dollar deficit in the Education Fund. The higher than projected deficit is due to an estimated $100K - $150K in grant funds that were spent in the FY25 fiscal year, but won’t be reimbursed by the State until next fiscal year (FY26). The District also made numerous purchases for FY26 supplies in this year in preparation of moving to TeacherEase Financials and away from Skyward Financial software. The District needed all POs to finalize in Skyward before making the transition to TeacherEase. That probably accounts for another $200K or so. The District also experienced just under $400K in an additional increase in Special Education costs from last year.

Last year’s (FY24) revenue in the Ed. Fund was estimated at $10,328,224. This year’s estimate is $10,237,828, a decrease of $90,396. With increasing costs due to inflation, it is no surprise that the District’s deficit has increased. Just in CPPT alone, we received just over $700K in FY23. This year, we are down to just over $300K, a loss of $400K. The District has been able to reduce costs, but those savings have been outweighed by the loss of revenue. The District utilized the Working Cash Fund to cover the deficit in the Ed. Fund. The District did have a positive balance in the Operations and Maintenance Fund as there weren’t any large issues with facilities this year. The District also experienced a much smaller deficit in the Transportation Fund than expected. At the conclusion of the year, the District should have just under $2 million in Working Cash to utilize for FY26.

May 15, 2025 Board Meeting Discussion: Working Cash (Kendall King, Kings Financial): Kendall reviewed and answered questions about the District’s intent to issue $4,000,000 in working cash bonds, aligning with prior discussions. This would ensure the District has funds available if consolidation efforts with AC-Central do not move forward. The Board’s intent is not to utilize working cash funds unless absolutely necessary and they would do so without a tax rate increase. They are issuing the intent only as a safety net to get either a consolidation vote or an increase in the education fund rate on the ballot for voters to consider. Currently, the district is operating on a $1.5 - $1.8 million deficit which has been offset by the use of working cash funds. The District is not only looking for a long term “fix” for the annual deficit, but believes that consolidation could be beneficial to both the AC-Central and PORTA communities as both districts have struggled with diminishing enrollments, making it more and more difficult to continue offering an assortment of high-quality courses/curriculum as well as finding qualified staff to teach in person AP and Dual Credit courses. Also, the lack of annual 1% County School Facility Tax (CSFT) generated in Menard County verses Cass County (Walmart in Beardstown) and Sangamon County (major metropolitan area). PORTA receives $382 per student while A-C Central receives $649 per student while districts in Sangamon receive over $1,000 per student. With the lower CSFT funds, the PORTA District is more reliant on property taxes.

The District is moving forward with the actions outlined at April’s Board meeting:

- Pass a Resolution of Intent to Issue Working Cash Bonds (approved at this Board meeting)

The Board of Education should pass a resolution of intent to issue working cash bonds at the May Board Meeting. The District would only need to issue these bonds if a consolidation question is not placed on the March 2026 ballot, or if the consolidation question fails. If necessary, the District could issue working cash bonds to fund operations for the 2026–2027 school year without a tax increase by restructuring current debt. - Pursue a Feasibility Study Following the Petition Period

If the Board successfully completes the 30-day petition period without challenge, the District would immediately collaborate with AC-Central to initiate a feasibility study. Based on the study's findings, both Boards could then determine whether to place a consolidation question on the March 2026 ballot. If the consolidation question is placed on the ballot and passes, a new district would be formed, and new tax rates would be established by the consolidated district. If the consolidation question is not placed on the ballot, or if it fails, the District would have the working cash bonds available to maintain operations through the 2026–2027 school year and could then prepare to place an Education Fund increase on the November 2027 ballot. - Prepare for an Alternative Plan if the Petition Period is Unsuccessful

If the District is unable to successfully complete the 30-day petition period, the Board would need to consider whether placing the Education Fund increase question on the March 2026 ballot would be more appropriate than pursuing the feasibility/consolidation question. In either event, based on debt restructuring, it is likely that this could be done without a tax increase.

April 24, 2025 Board Meeting Discussion: Timeline: Ed Fund Referendum/Feasibility Study (Consolidation)/Working Cash (Kendall King, Kings Financial): Kendall reviewed the District’s current debt limits along with all four outstanding bond issues:

- Series 2020A (Working Cash Bond): Remaining balance of $1,831,500, scheduled to be paid off on December 1, 2025.

- Series 2020B (Health, Life Safety Bond): Remaining balance of $3,935,225, scheduled to be paid off on December 1, 2027.

- Series 2022 (Alternative Revenue Bond): Remaining balance of $1,294,575, scheduled to be paid off on December 1, 2030. This bond is funded through Facility Sales Tax (CSFT) revenues.

- Series 2024 (Working Cash Bond): Remaining balance of $4,178,484, scheduled to be paid off on December 1, 2028.

Currently, the three bonds impacting the District’s tax rate are the Series 2020A, Series 2020B, and Series 2024, totaling $9,945,209.

Both Series 2020B and Series 2024 are callable as of December 1, 2025, meaning they can be refinanced. This provides the District an opportunity to issue new working cash bonds without increasing the tax rate by restructuring the existing debt. This refinancing approach aligns with the original plan when the Series 2024 Working Cash Bond was issued two years ago.

Mr. King then reviewed the District’s current tax rate, Equalized Assessed Valuation (EAV), and 1% County School Facility Tax (CSFT) revenues compared to neighboring and regional school districts.

PORTA receives significantly less CSFT revenue—$382 per student—compared to nearby districts:

- A-C Central: $694 per student

- Athens: $547 per student

- Auburn: $1,234 per student

- Ball-Chatham: $1,077 per student

- New Berlin: $1,171 per student

- Pleasant Plains: $1,722 per student

- Riverton: $1,182 per student

- Rochester: $1,107 per student

- Williamsville: $1,110 per student

Because PORTA receives less CSFT revenue, it must rely more heavily on local property taxes to cover facility costs, contributing to a higher tax rate.

Current tax rates for area districts are as follows:

A-C Central 5.07

Athens 4.75

Auburn 3.91

Ball-Chatham 4.53

New Berlin 4.42

Pleasant Plains 4.97

Riverton 4.24

Rochester 4.46

Springfield 5.69

Williamsville 4.39

PORTA 5.38

If CSFT revenues were factored in (adjusting other districts’ rates upward to simulate the absence of CSFT), PORTA’s adjusted comparison shows it to be very competitive:

District Adjusted Tax Rate (Including Potential CSFT Offset):

A-C Central 5.37

Athens 5.08

Auburn 4.70

Ball-Chatham 5.05

New Berlin 4.78

Pleasant Plains 5.71

Riverton 5.16

Rochester 5.12

Springfield 6.30

Williamsville 4.97

PORTA 5.56

In addition, when compared to school districts in McLean County—which generally do not receive CSFT revenue—PORTA’s tax rate remains in line with regional norms.

Based on this financial analysis, PORTA’s tax rate is consistent with other districts when factoring in outside influences such as CSFT funding levels and higher EAVs found in districts with wind farms, nuclear plants, or proximity to larger metropolitan areas.

After reviewing the current debt structure of the District, Kendall recapped a brainstorming session that was held with the Superintendent, a representative from an architectural firm that has worked with the District in the past, a representative from a company who provides referendum support, and the president of the teacher’s union. The purpose of the meeting was to discuss the timeline for a possible referendum to either raise the Education Fund levy by shifting the tax burden from Bonds and Interest to the Education Fund, or a possible referendum on consolidation.

After much discussion, the group agreed it would be more appropriate to focus on a referendum for consolidation rather than pursuing an Education Fund increase at this time. The consensus was that both the AC-Central and PORTA Boards would likely move forward with a feasibility study, which could lead to a consolidation question being placed on the ballot. If consolidation becomes a possibility, pursuing an Education Fund increase now would be premature, as all tax rates would be redeveloped through the feasibility study and included in the consolidation referendum.

Based on this scenario, the District should consider the following actions:

- Pass a Resolution of Intent to Issue Working Cash Bonds

The Board of Education should pass a resolution of intent to issue working cash bonds at the May Board Meeting. The District would only need to issue these bonds if a consolidation question is not placed on the March 2026 ballot, or if the consolidation question fails. If necessary, the District could issue working cash bonds to fund operations for the 2026–2027 school year without a tax increase by restructuring current debt. - Pursue a Feasibility Study Following the Petition Period

If the Board successfully completes the 30-day petition period without challenge, the District would immediately collaborate with AC-Central to initiate a feasibility study. Based on the study's findings, both Boards could then determine whether to place a consolidation question on the March 2026 ballot. If the consolidation question is placed on the ballot and passes, a new district would be formed, and new tax rates would be established by the consolidated district. If the consolidation question is not placed on the ballot, or if it fails, the District would have the working cash bonds available to maintain operations through the 2026–2027 school year and could then prepare to place an Education Fund increase on the November 2027 ballot. - Prepare for an Alternative Plan if the Petition Period is Unsuccessful

If the District is unable to successfully complete the 30-day petition period, the Board would need to consider whether placing the Education Fund increase question on the March 2026 ballot would be more appropriate than pursuing the feasibility/consolidation question. In either event, based on debt restructuring, it is likely that this could be done without a tax increase.

The Board also discussed the importance of significantly improving communication with the community regarding this approach, especially given concerns about the lack of public information during the working cash issuance two years ago. Clear and proactive messaging will be critical. The Board will need to decide on a direction at the May meeting, given that a feasibility study process requires substantial time. It will also be important to gauge AC-Central’s willingness to accelerate the timeline for completing a feasibility study and preparing a consolidation question for the March 2026 ballot.